Jim Cramer’s method has at all times been sensible and sure about monetary freedom after retirement. He runs the CNBC making an investment membership, which is helping other people make worthy funding selections to enlarge their cash. As well as, Cramer is the co-founder and chairperson of TheStreet.

Born to ingenious oldsters, Cramer has at all times been favored for his distinctive talent to offer logical monetary ideas. Are you aware what Cramer says about early retirement? This put up unveils the name of the game – stay studying and be told the mysteries concerned!

Contents

- 1 Cramer’s Tackle Early Retirement

- 2 How Will have to You Plan for Early Retirement?

- 3 1. Know Your Taste

- 4 2. Center of attention on Compounding

- 5 3. Set Sensible Objectives

- 6 4. Don’t Forget about the Well being Issue

- 7 5. Make a choice the Proper Funding Car

- 8 6. Set up Your Portfolio Sensibly

- 9 7. Calculate your Requirement

- 10 8. Know the 4% Principle

- 11 9. Use Low cost Index Budget

- 12 10. Expense Test is Obligatory

- 13 11. Steer clear of Money owed

- 14 12. Imagine Passive Source of revenue

- 15 Information About Early Retirement That You Shouldn’t Forget about

- 16 1. Unpredicted Spending

- 17 2. Increased Prices

- 18 3. Burdensome Housing Bills

- 19 FAQs

- 20 1. What occurs in case you retire early?

- 21 2. What’s the splendid age to retire?

- 22 3. How are you able to conveniently get ready for early retirement?

- 23 4. Will have to you retire early?

- 24 5. What did Cramer say about early retirement?

Cramer’s Tackle Early Retirement

Jim Cramer revealed a guide referred to as ‘Actual Cash’ in 2005. On web page quantity 66 of the mentioned guide, Cramer mentioned – “the age-specific funding method is your only option.” Those strains replicate how the most important it was once for Cramer to save lots of for retirement. He believes everybody will have to get started saving for retirement as early as conceivable.

Cramer began his occupation with the Tallasahi democrat. In 1977, he were given his first secure paycheck. Alternatively, when he left Talasahi, he handed via difficult occasions. He was once dwelling in his automobile when he used to paintings as a reporter in Los Angeles. Impressively, dodging that hostile monetary scenario, Cramer controlled to position $1500 away for his retirement.

He says he invested the cash within the well-known Peter Lynch at Constancy Magellan Fund. Consistent with Cramer, that cash was once being invested for a couple of years persistently. This, in flip, helped him to compound the cash to such an extent that it will supply a average retirement source of revenue to are living lavishly for no less than a part dozen years post-retirement.

Within the crack of dawn of 2023, Cramer’s ideology turns out very relatable. Saving for retirement hasn’t ever been this the most important – the process marketplace has long past insanely volatile, and the financial system craves oxygen as a result of inflation. That is excessive time to undertake an age-specific mindset, as Cramer explains – you will have to focal point on expansion shares for your 20s as a result of you could have sufficient time to take and organize dangers.

Whilst you input your 30s, you will have to pull the chain somewhat onerous and turn to extra solid shares like dividends. Transferring on on your 40s, bonds will have to make up a extra good portion of your portfolio since that is the time to prioritize capital preservation.

Consistent with Cramer, given the disrupted financial scene in america, even extremely curated plans for retirement might fail. Subsequently, you will have to transfer to the opposite of retiring early. Alternatively, how will have to you progress against early retirement?

How Will have to You Plan for Early Retirement?

Cramer articulates that sticking to a technique out of your early 20s might assist you to retire early and revel in monetary freedom. There are a number of components to believe, together with the next.

1. Know Your Taste

If you find yourself starting, it’s the most important to grasp the place you stand. Preferably, you’ll want 70% of your annually source of revenue to gasoline your annually bills after retirement. Subsequently, determine your provide monetary place and search for tactics to protected that proportion so you’ll be able to retire early and no longer see poverty post-retirement.

2. Center of attention on Compounding

Most effective compound pastime can develop your cash considerably. If you wish to estimate how briefly you’ll be able to multiply your cash, you simply wish to determine the years had to develop it at a given rate of interest. As an example, if the rate of interest is 10%, it is going to take roughly seven years to develop $1000 into $2000. If you need extra advantages, you’ll be able to believe high-yielding shares.

3. Set Sensible Objectives

Be reasonable when sporting out the calculation. If you’re retiring early, you’ll most probably are living a very long time with out paintings. Is the undertaking going to be riskier than you bargained for? Will you be capable to organize sufficient cash to revel in your retirement? Re-examine the criteria prior to you are saying good-bye on your process. Take note, leaving your retirement solely on double-digit funding returns isn’t smart. Therefore, watch out!

4. Don’t Forget about the Well being Issue

The entirety about retirement is probably not that juicy. You might enjoy well being problems that may make a large hollow for your pocket. Subsequently, get well being quilt that assist you to together with your health facility expenses.

5. Make a choice the Proper Funding Car

When you’ve got determined to retire early, you’re most probably able to compromise the relaxation of your per month wage. Subsequently, you can use the restricted time period to save vastly in your retirement years. As an example, in case you began incomes on the age of 18 and you’re making plans to retire for your 40s, you’ll have roughly 20-22 years to develop your cash and save in your retirement.

Given this, you will have to be very specific when choosing funding tools. At all times stroll with the choices that make certain sizeable returns through the years. But even so, they will have to be capable to beat inflation. You’ll be able to flick through equity-based choices or annuity plans to protected an ordinary float of source of revenue.

6. Set up Your Portfolio Sensibly

Most effective consistency assist you to achieve your function with regards to retiring early. Subsequently, be common together with your funding and organize your portfolio actively. Should you in point of fact need to maximize your returns, believe tracking your investments carefully. You will have to be capable to determine which investments will fit your needs and which gained’t.

The investments you could have made prior to now will have to even be reanalyzed. Test in the event that they dangle their floor within the provide day and feature helped battle inflation. If their efficiency doesn’t appear promising, take out your cash and put them in the suitable tools.

7. Calculate your Requirement

You’ll be able to do that through regarding the guideline of 25. This says that you just will have to gain 25X your deliberate annual spending prior to retiring. As an example, if you wish to spend $40,000 throughout the primary 12 months of retirement, you’ll have $10,00,000 invested whilst you go away your process. Whilst you make investments your retirement nest egg, it is going to keep growing. This manner, they are going to be capable to stay alongside of the inflation.

8. Know the 4% Principle

The 4% rule is a extensively permitted thought for retirement making plans. It means that you’ll be able to withdraw 4% of your invested financial savings throughout the primary 12 months of retirement. In a while, you’ll be able to alter the withdrawal quantity for inflation yearly. Even if you don’t have to stick strictly to the 4% rule, you’ll be able to make changes in accordance with your chance tolerance, marketplace efficiency, and funding portfolio.

9. Use Low cost Index Budget

Retiring early comes with two transparent downsides – a shorter span to save lots of and an extended length to spend. You want to succeed in the most productive returns to dodge them, which can also be completed through construction a balanced portfolio vulnerable to long-term expansion. You’ll be able to use low cost index price range to succeed in this function. Normally, such price range include allocations tilted towards shares, and you’re loose to abdomen them so long as you’ll be able to.

10. Expense Test is Obligatory

Smartly, you’ll have completed plenty of homework to determine how a lot it is important to spend your retirement conveniently. Alternatively, estimating the bills generally is a dialogue. Normally, it begins in an blameless means – you throw that obligatory retirement birthday party. After a couple of days, boredom hits, and also you move out for a holiday. Then, you wish to have a spouse, so that you get a canine. Smartly, now the 4% rule, as discussed above, unexpectedly kicks in.

You will have to steer clear of this situation. You made a decision to stick with that rule to overcome inflation. It could possibly by no means assist you to in case you mindlessly spend a lot past your capability. Should you building up your routine bills for your retirement, you’ll most likely run out of cash quickly.

11. Steer clear of Money owed

Money owed is usually a hindrance on your early retirement efforts. If you find yourself caught with debt, you’ll to find it difficult to obtain sufficient cash to enhance your post-retirement existence. Preferably, you will have to observe the elemental 30:30:30:10 budgeting rule to steer clear of monetary burdens.

As such, you will have to devote 30% of your per month source of revenue to housing wishes, 30% to groceries, utilities, and gasoline, 10% to discretionary bills, and 30% on your financial savings and investments. Through following this rule, it is possible for you to to save lots of in a strategic and disciplined means.

12. Imagine Passive Source of revenue

Construction a passive source of revenue flow might assist you to retire early, and there are a number of tactics to take action. For instance, you’ll be able to get started taking over freelancing initiatives or put money into dividend belongings. But even so those two, you’ll be able to additionally believe a number of different ways to generate passive source of revenue. They’ll come with actual property making an investment, online marketing, and growing and promoting virtual merchandise. The bottom line is to discover a manner that works for you, and that aligns together with your monetary objectives.

Information About Early Retirement That You Shouldn’t Forget about

Now that you’re accustomed to the secrets and techniques of early retirement, listed below are some lesser-known info that assist you to make an educated determination. Take note, the whole thing about retiring early isn’t candy, and also you will have to be ready to embody its sour aspect as neatly.

1. Unpredicted Spending

As highlighted prior to, in retirement, you’ll most often wish to spend most effective 70% of what you spent whilst you have been operating. For instance, in case you spend $10000 annually when operating, it’s anticipated to change into $7000 whenever you retire. There gained’t be liabilities comparable to shoveling cash into your retirement account, paying social safety taxes, and bearing the communique value for paintings. Alternatively, within the early years of retirement, you’re anticipated to spend greater than you deliberate to gasoline your newly retired way of life.

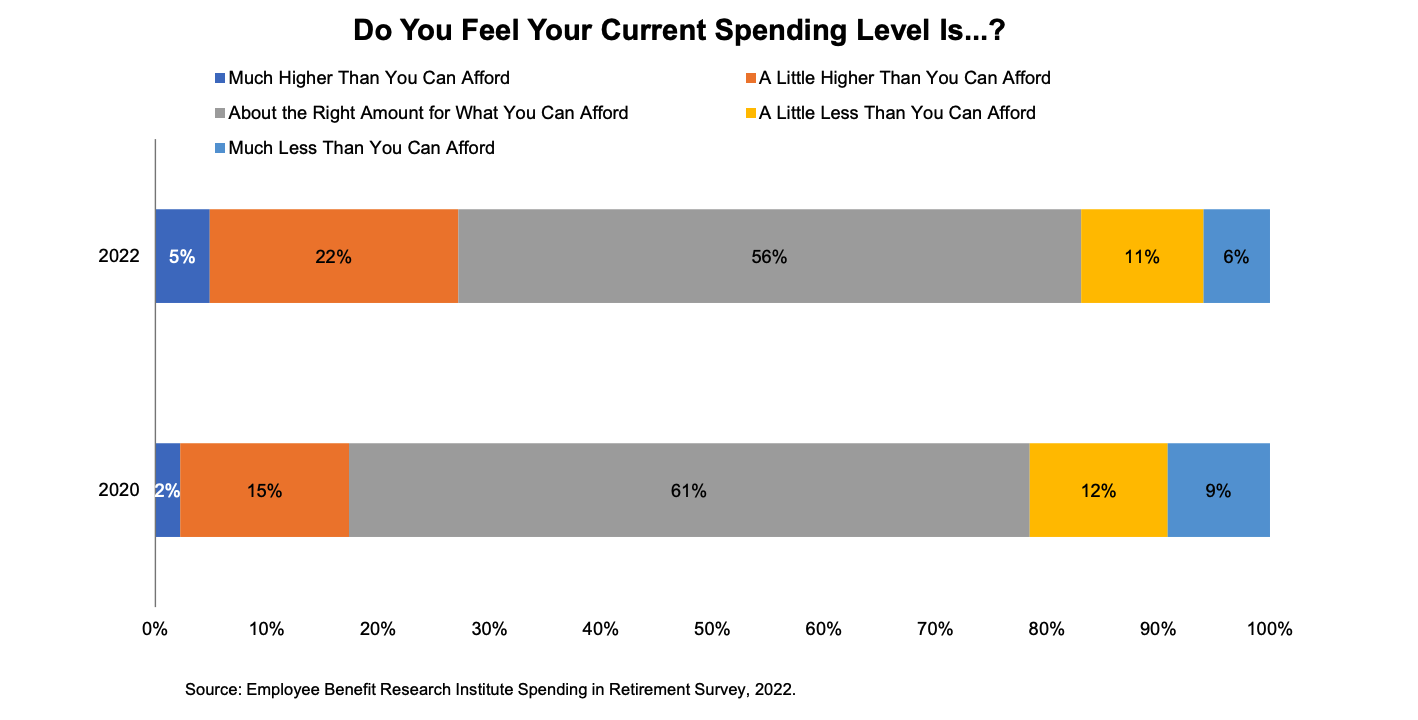

Additionally, the inflation fee is operating at a red-hot 8.3% now. No person can say it is going to surge to what extent whilst you retire. Given this, you might wish to revise your retirement financial savings plan significantly. EBRI finds that 36% of retirees agree that their general bills were upper than their calculations. Taking into consideration those info, you will have to get started saving much more rigidly to spend your retirement in convenience and peace.

2. Increased Prices

Once in a while tapping your nest egg early might value you considerably. Retiring prior to 59 makes you more likely to pay a ten% early withdrawal penalty from tax-deferred accounts like 401 (Ok) plans and IRSs. Additionally, in case you don’t have a Roth IRA, funded with after-tax contributions, your withdrawals from conventional accounts might be subjected to tax implementations.

As an example, in case you withdraw $40,000 prior to you hit 59 and are available beneath the 15% federal tax bracket, you’re anticipated to pay $10,000 in consequences and taxes. This may increasingly go away you with $30,000 in hand.

3. Burdensome Housing Bills

If you’re retiring with a loan, your housing bills gained’t retire with you. Thus, you will have to at all times check out paying off your loan prior to you are saying good-bye on your process. Alternatively, although you organize to pay your loan, you will have to watch out about your own home taxes and residential upkeep prices and plan your retirement price range accordingly.

FAQs

1. What occurs in case you retire early?

Retiring early comes with a suite of professionals and cons. The advantages might come with a number of components. As an example, you’ll be able to revel in a possibility to start out a brand new occupation. Moreover, early retirement means that you can spend extra time touring and exploring other dimensions of existence. Most significantly, you probably have deliberate strategically, early retirement assist you to cherish monetary freedom.

Alternatively, there are downsides as neatly. First, your social safety advantages might be decreased. Subsequent, you might battle to make your retirement financial savings last more. In the end, the way of life transition might impact your psychological well being.

2. What’s the splendid age to retire?

Smartly, the solution is lovely self-explanatory. The general public consider the usual retirement age will have to vary between 60 and 65. In reality, in case you retire at this age, you’ll be able to draw your complete social safety retirement advantages. Alternatively, relying for your monetary scenario, you might come to a decision to retire early or overdue. There is not any definitive formulation that assist you to to find the suitable age for retirement. Thus, believe your objectives when making the verdict. You’ll be able to additionally take skilled assist from monetary advisors to make the suitable determination.

3. How are you able to conveniently get ready for early retirement?

To set your self loose prior to you hit your 59, you should plan your funds strategically. You will have to put money into the suitable tools, stay monitor of your price range, and save adequately in your long run. As well as, you will have to acquire well being protection to maintain unexpected clinical emergencies.

4. Will have to you retire early?

Sure and no! Should you plan to start out a brand new undertaking after your 40s and your process obstructs your means, you might believe the thought of early retirement. In a similar fashion, you’ll be able to retire early if you wish to revel in a burden-free existence somewhat previous than the usual norms. Alternatively, in case you are stressed with loans and feature no longer been in a position to control your funds neatly up to now, you will have to assume completely prior to deciding to retire early.

5. What did Cramer say about early retirement?

Jim Cramer has at all times been sure concerning the thought of early retirement. In reality, he regarded as it one of the crucial perfect guns to overcome inflation and are living a worry-free existence. Alternatively, Cramer has really useful a couple of to-dos to procure the most productive advantages of early retirement. They come with strategic and constant financial savings, consciousness of the current monetary situation, and so on.

The put up Jim Cramer’s Secret to Early Retirement is Now Public seemed first on Due.

Supply Through https://www.entrepreneur.com/finance/jim-cramers-secret-to-early-retirement-is-now-public/449302