The cryptocurrency marketplace has been experiencing some fluctuations just lately, with Bitcoin and Ethereum, the 2 most generally used cryptocurrencies, dealing with a slowdown. Bitcoin is these days being traded at $24,000, experiencing a slight drop from yesterday because of considerations over marketplace liquidity.

The cryptocurrency marketplace has been experiencing some fluctuations just lately, with Bitcoin and Ethereum, the 2 most generally used cryptocurrencies, dealing with a slowdown. Bitcoin is these days being traded at $24,000, experiencing a slight drop from yesterday because of considerations over marketplace liquidity.

In a similar fashion, Ethereum has observed a three% decline previously 24 hours and is these days buying and selling at $1,600.

The cryptocurrency marketplace has just lately skilled some ups and downs, with the 2 most generally used cryptocurrencies, Bitcoin and Ethereum, dealing with a slowdown.

Moreover, different common cryptocurrencies similar to Dogecoin, Solana, Ripple, and Litecoin have all misplaced floor.

Alternatively, the declines had been pushed via ongoing considerations about Credit score Suisse, a financial institution in Europe this is dealing with demanding situations. Traders are anxious that this might result in a banking disaster, which might impact Bitcoin costs within the brief time period.

Contents

- 1 Bitcoin Drops to $24,000 as Crypto Marketplace Faces Downward Stance Amidst Signature Financial institution Closure

- 2 US PPI and Financial Uncertainty Weigh on BTC

- 3 Bitcoin Value

- 4 Ethereum Value

- 5 Best 15 Cryptocurrencies to Watch in 2023

- 6 In finding The Very best Value to Purchase/Promote Cryptocurrency

Bitcoin Drops to $24,000 as Crypto Marketplace Faces Downward Stance Amidst Signature Financial institution Closure

Bitcoin’s fee has skilled a vital decline, and the cryptocurrency marketplace has been most often downward in recent times. In conjunction with the lower in Bitcoin’s worth, there was some information in regards to the closure of Signature Financial institution.

Some buyers had been involved that the closure may well be associated with cryptocurrency, which may have additional impacted the marketplace. Alternatively, the New York Division of Monetary Services and products (NYDFS) has clarified that the closure isn’t related to cryptocurrency.

The New York Division of Monetary Services and products (NYDFS) has reassured buyers that the hot closure of Signature Financial institution isn’t associated with any cryptocurrency considerations.

However, the cryptocurrency marketplace has been suffering, with Bitcoin’s worth experiencing a vital drop. Traders are tracking the location carefully, however the marketplace seems to be dealing with demanding situations within the brief time period.

US PPI and Financial Uncertainty Weigh on BTC

The hot US Manufacturer Value Index information has been certain, however buyers stay wary because of considerations about international banks and the entire state of the economic system. Regardless of a temporary spike in worth, Bitcoin and different cryptocurrencies skilled a worth decline.

This downward pattern will also be attributed to a number of elements, together with ongoing troubles with international banks, in particular considerations surrounding Credit score Suisse, which has raised worries about marketplace liquidity. Consequently, some buyers are changing into uneasy and promoting their holdings, resulting in a drop within the worth of cryptocurrencies similar to Bitcoin.

Moreover, the macroeconomic setting stays slow, and financial uncertainty and banking considerations have created a wary buying and selling setting. Consequently, buyers are changing into extra cautious about the place they make investments their cash, which is contributing to the downward pattern of Bitcoin and different cryptocurrencies.

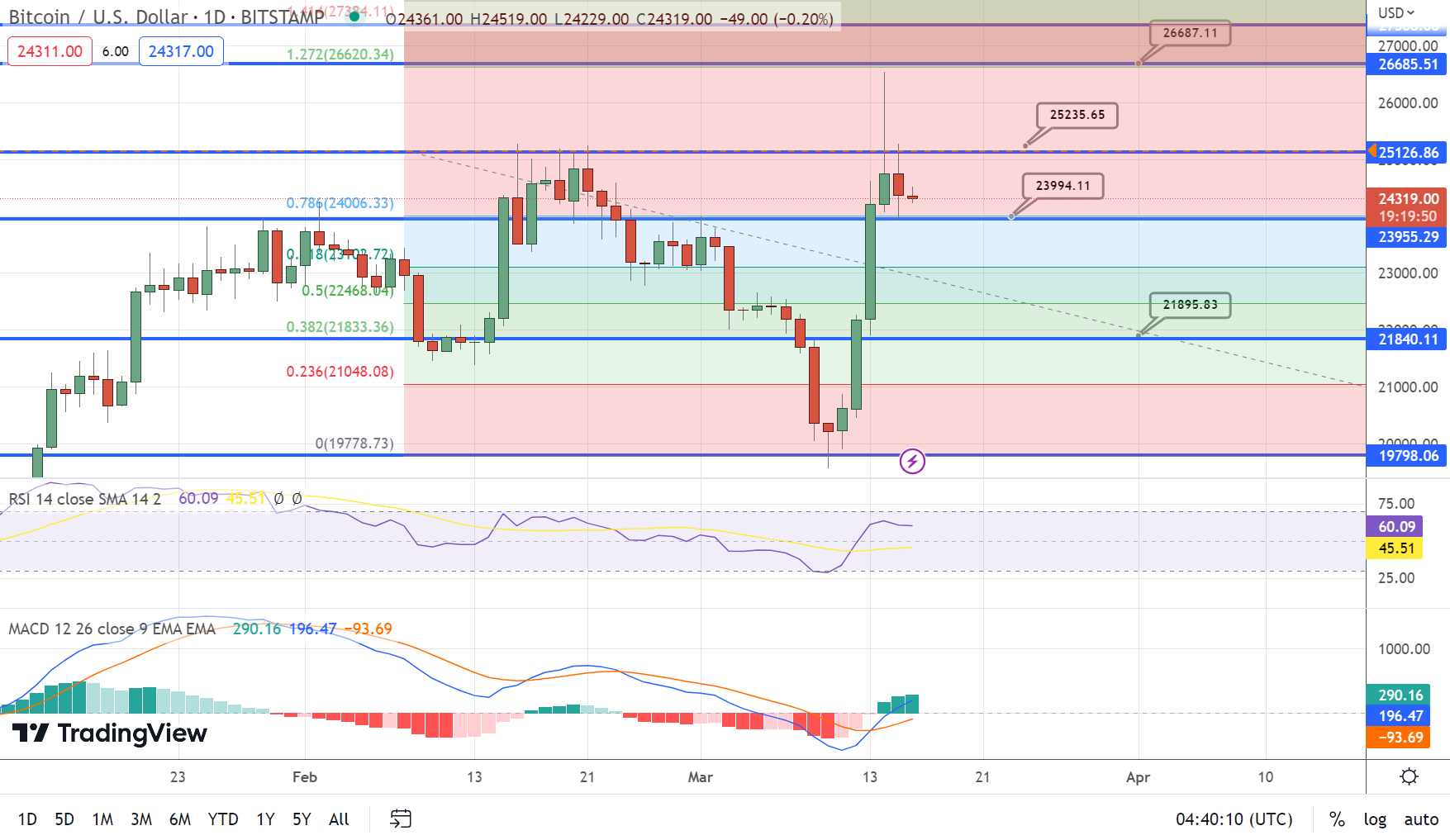

Bitcoin Value

Following a temporary consolidation at $26,500, the Bitcoin fee has skilled a pointy decline. Consequently, it’s been on a non permanent unfavourable pattern because it broke beneath the $25,000 and $25,500 assist ranges.

If the cost can shut over $25,200, it will cause a brand new uptrend above $26,000, with a vital resistance stage on the $26,500 zone. If $26,000 is damaged, $27,500 is probably not a long way at the back of.

But, Bitcoin may see every other dip if it can not ruin in the course of the $25,200 resistance stage.

These days, $24,000 is offering near-term assist at the drawback, with the $23,500 space and the 100-hourly easy shifting reasonable offering further, extra really extensive assist no longer a long way at the back of.

Every time the cost drops beneath $22,600, the marketing drive is prone to building up. If losses persist, the cost may drop beneath $22,000.

Purchase BTC Now

Ethereum Value

After breaking in the course of the $1,600 barrier, Ethereum’s fee started a vital ascent. For ETH to advance even farther into a good zone, similar to bitcoin, it needed to ruin in the course of the the most important $1,700 barrier zone.

The associated fee in any case broke in the course of the $1,745 barrier and was once buying and selling towards $1,800. A height was once established as regards to $1,784, after which there was once a retracement to the unfavourable.

If Ethereum cannot ruin via $1,745, shall we see every other drop. Within the brief time period, the fashion line and the $1,695 fee level will supply as early assist for the marketplace.

Purchase ETH Now

Best 15 Cryptocurrencies to Watch in 2023

Take a look at Cryptonews’ Business Communicate staff’s curated checklist of the highest 15 altcoins to look at in 2023. The checklist is ceaselessly up to date with new ICO initiatives and altcoins, so you should definitely consult with incessantly for the most recent updates.

Disclaimer: The Business Communicate segment options insights via crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.

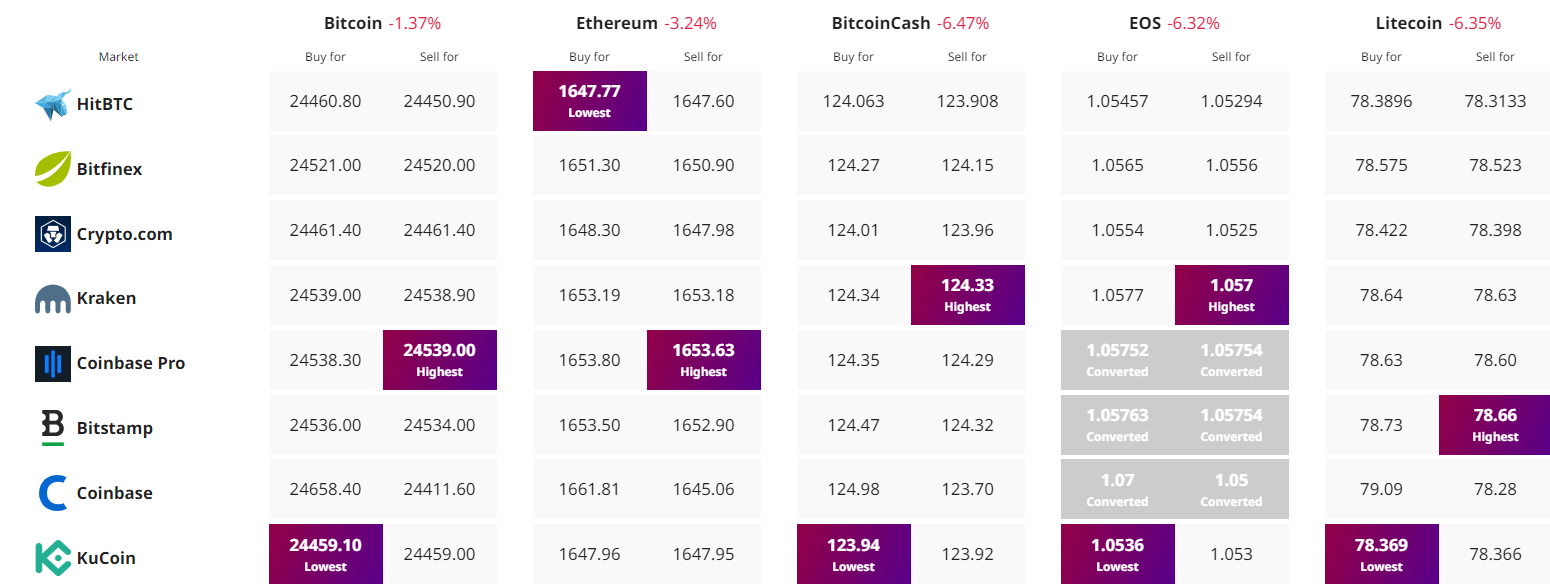

In finding The Very best Value to Purchase/Promote Cryptocurrency

Supply By means of https://cryptonews.com/information/bitcoin-price-ethereum-prediction-btc-finds-support-at-24000-will-there-bullish-rally.htm